Receiver / Fiduciary of $409 Million California Lead Paint Abatement Fund

Cash Management, Strategic Plan, Reporting

The Bottom Line:

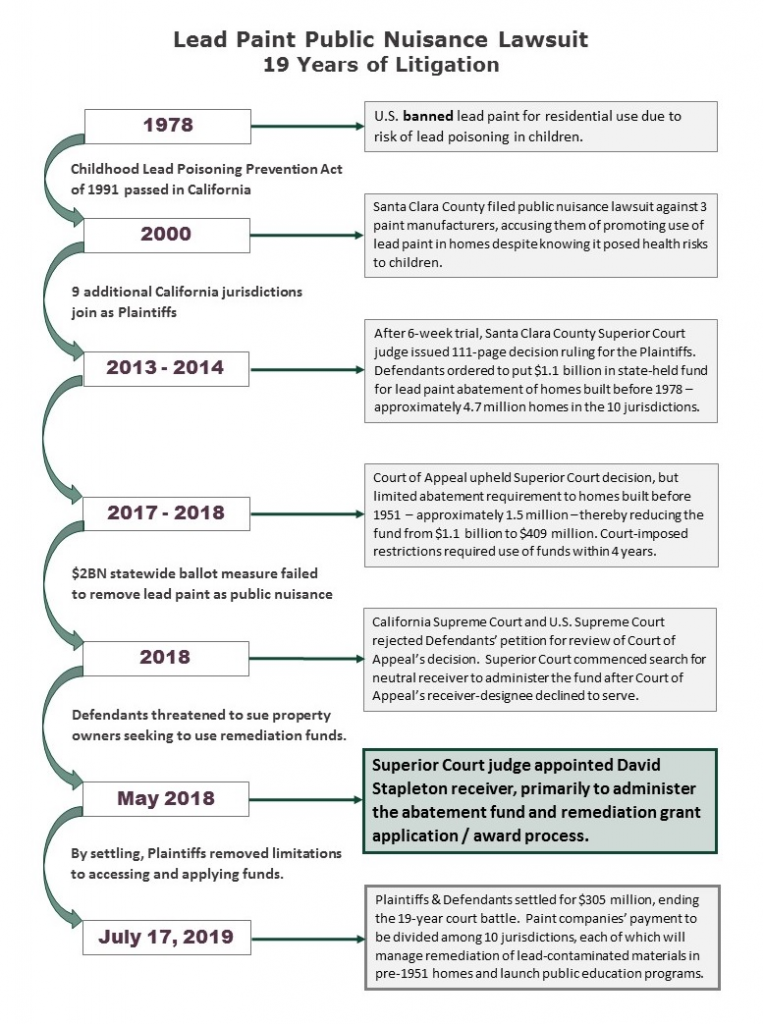

After nearly 20 years of contentious litigation regarding lead paint use in residences, David Stapleton (Stapleton Group) was appointed receiver of the $409 million lead paint abatement fund awarded to Plaintiffs by the Appellate Court in The People of the State of California v. ConAgra Grocery Products Company, et al. (“Abatement Fund”). The appointment followed a six-month competitive process among ten qualified receivers. About one-year later, Plaintiffs and Defendants settled the matter for $305 million.

Competitive, Intensive Appointment Process:

The Appellate Court designated a branch of the California Department of Public Health as receiver. When the branch declined to serve, the Superior Court pursued a competitive process to identify a receiver with the experience necessary to administer the abatement fund and the remediation grant application and award process.

Stapleton Group was appointed receiver after an arduous 6-month process among ten qualified receivers. The candidates responded to multiple RFPs and interviews. The finalists provided live testimony in courtroom evidentiary hearings in front of the judge.

Stapleton’s credentials relative to serving as Receiver for the $409 million Abatement Fund include:

- Successfully concluded 250+ engagements over 10+ years

- Expertise building consensus among opposing parties for their mutual benefit

- Proven ability to serve as a fiduciary in large matters with complex compliance and reporting requirements, such as BIC Real Estate Development Corporation, et al.; Pappas Telecasting Companies; Velocity Investment Group; and, Visser Dairy.

- Large, experienced, in-house team

- Extensive residential real estate remediation and inspection experience

Obstacles & Stapleton’s Solutions:

- The judge expected the receiver to resolve the Plaintiff’s and Defendant’s opposing views on multiple issues relating to the receivership order and grant application language.

- Stapleton held multiple drafting sessions with both parties.

- Stapleton engaged its counsel and, when necessary, the judge to achieve agreement among the parties on language for the receivership order.

- Multiple hearings were held during which the judge frequently asked Stapleton for his opinion based on his experience.

- The $409 million Abatement Fund was to be held in a non-interest bearing account.

- Stapleton identified multiple alternatives and solicited proposals to earn interest on the funds while limiting risk to the principal.

- Stapleton achieved agreement among the parties to invest the Abatement Fund in U.S. Treasuries with varying maturities, thereby maximizing ROI while minimizing principal risk.

- Stapleton’s solution was projected to generate approximately $15 million of incremental cash during the receivership period.

- Insurance coverage for the sub-contractors hired to remediate the lead paint pursuant to the settlement was expensive, diminishing the funds available for abatement.

- Stapleton investigated alternatives and proposed an OCIP “wrap” master insurance policy covering the Defendants, paint companies and sub-contractors to reduce costs.